ESG integration in listed equity: A technical guide

This guide aims to support listed equity investors in integrating environmental, social and governance (ESG) considerations into their strategies. It is intended as a resource for those looking to review or update ESG policies and practices over time, but will also cater to those developing a responsible investment approach for the first time.

Online summary

This online summary version of the guide provides an overview and introduction to the content. For the full version, including signatory practice examples and case studies, please click below:

Background and drivers

PRI data shows that the integration of ESG factors into listed equity analysis and investment is widespread among our signatories. Investors are also increasingly willing to wield their voting power and collaborate in holding companies to account.

There are four principal drivers of this progress:

- Client demand: Growing demands from beneficiaries and clients for greater transparency about how their money is invested

- Regulation: More guidance from regulators that considering ESG factors is part of an investor’s fiduciary duty

- Sustainability outcomes: Growing interest from investors and other stakeholders in examining how investment decisions affect real-world outcomes

- Materiality: Increasing recognition that certain ESG factors can affect risk and return

ESG integration in listed equity: A five-part process

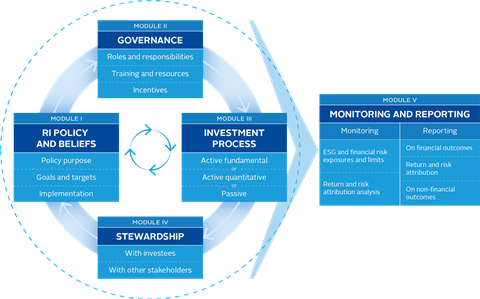

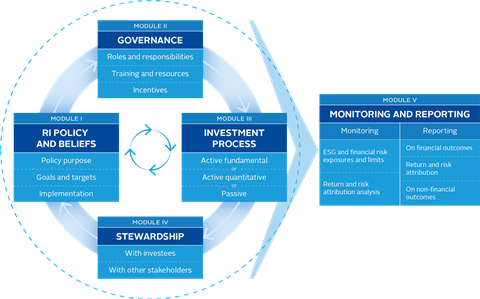

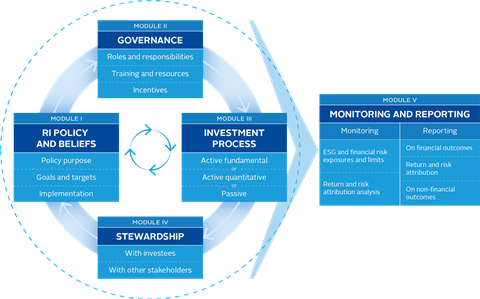

The PRI defines ESG integration as “the process of including ESG factors in investment analysis and decisions to better manage risks and improve returns”. The listed equity investment process can be split into five stages, which in practice form an investment cycle, as shown in Figure 1 below. This guide will explore how PRI signatories are integrating ESG into each.

Figure 1: ESG integration in listed equity: a five-part process

Show Fullscreen

Module I: Policy

First, investors will set their intentions, and make public commitments, through a responsible investment policy. These have evolved rapidly in recent years into sophisticated documents with a wealth of detail on ESG practices. The PRI has compiled a searchable database of responsible investment policies from more than 1,500 investors, which our signatories can review, adapt or develop from as they consider their own approaches.

Module II: Organisational Governance

Governance arrangements ensure that the commitment to responsible investment is followed through by firms. Sound governance is therefore key to ensuring accountability. This includes clearly defined roles and responsibilities; staff training and education on ESG issues; and appropriately structured fee and remuneration arrangements.

Module III: Investment Process

This module consists of three sections, each focused on a particular investment style: active fundamental, active quantitative and passive investments. Additionally, stewardship activities (voting and engagement) are not easily separable from the investment process, because stewardship is informed by, and feeds back into, insights gained during the investment process. Therefore, these sections also look at how to implement stewardship activities.

ESG integration in active fundamental strategies

ESG considerations can be brought into the processes of fundamental analysis, forecasting, valuation and portfolio construction in a variety of ways; but responsible investors should treat it as core to the process, not an add-on.

- Stage 1 – Analysis: Investors can include ESG megatrends such as climate change alongside their consideration of economic and geopolitical conditions. These can be considered at regional and sector level, as well as their impact upon individual stocks. When considering ESG factors, analysts also need to consider their materiality – how significant they are for the company in question. Resources such as the financial materiality maps from the Sustainability Accounting Standards Board can be used as a starting point.

The analysis stage is also key for investor stewardship, as investors can identify potential operational improvements that can be pursued through engagement with company management.

- Stage 2 – Forecasting and valuation: Traditionally, many investment managers would make forecasts of a company’s key financial metrics (earnings, cash flow) and then subsequently adjust these to take ESG factors into consideration. But a more thorough integration of ESG factors takes these into account during the process of analysis and forecasting in the first place. Analysts then use a variety of valuation models to determine an estimated intrinsic or fair value of the stock; all can be adjusted to reflect ESG factors.

- Stage 3 – Portfolio construction: The analysis performed in steps 1 and 2 lead to buy, sell or hold decisions. But professional investors also need to consider the impact of these upon the overall makeup of their portfolios. ESG risk factors can be included too; for example, a check that a given buy or sell decision would not breach a set limit on the level of CO2 emissions associated with stocks in the portfolio. The outcomes of company engagement can also influence decisions on whether to continue to hold or sell stocks.

ESG integration in active quantitative strategies

ESG considerations can be incorporated into quantitative strategies as factors (or characteristics) of stocks, where they are quantifiable and grounded in evidence. ESG data availability has improved significantly in recent years, prompting greater exploration of ESG factors by quant managers.

Quant processes can also be split into three stages:

- Stage 1 – Investment strategy design: The process begins with a hypothesis that should be grounded in economic theory and supported by empirical evidence. Investors use statistical analysis to identify possible drivers of returns. For many ESG factors, the evidence base is still evolving; emissions data or gender and diversity statistics, for example, typically lack long-term evidence of being persistently rewarded or punished by the market.

Quant investors can also use ESG filters to put parameters around their portfolios, such as a minimum score on a range of environmental, social or governance factors.

- Stage 2 – Model testing and evaluation: This involves feeding historical financial data into the model to understand how it would have performed had it been implemented in the past. This can be a challenge with new datasets, including some ESG data.

- Stage 3 – Portfolio construction and implementation: Once the model is launched and running, it may need updating if market conditions change substantially. The ongoing development of ESG data may also spur refinements in the strategy over time.

ESG integration in passive strategies

Using passive strategies does not preclude an investor from considering ESG issues. Choosing to allocate to a fund that mimics an index is itself an active decision by the investor, and there are large numbers of ESG indices that have been developed for this purpose. ESG-conscious investors can also create or commission custom-built ones. Such indices may employ exclusions, such as removing all tobacco companies, or be based on an ESG rating or scoring system. Some regulators, such as the European Commission’s Technical expert group on sustainable finance, have set guidelines for the creation of new climate-transition benchmarks.

Passive strategies also have implications for investor stewardship, which include:

- long-term relationships with issuers: because passive investors do not actively trade in and out of stocks, they may be able to pursue longer-term engagements,

- incentives to consider systematic issues: such investors also benefit from rising share prices across an entire market, and so may consider using stewardship to address market-wide issues,

- differences in strategy: given their large numbers of holdings, it may not be practical for passive managers to pursue detailed engagements with company management in the same way an active manager can. Passive investors may consider different levers to achieve their stewardship objectives, such as engaging policy makers.

Module IV: Stewardship

Stewardship comprises three principal activities: engagement, voting, and escalation and divestment. The links between these activities and the processes of analysis, stock selection and portfolio construction are explored throughout Module IV.

Module IV provides an overview of additional PRI guidance on these stewardship activities, as well as ways to influence other stakeholders beyond investee companies.

Module V: Monitoring and reporting

Once a fund or strategy is launched, investors will monitor their portfolios to ensure they perform as desired. Investors are increasingly using ESG measures in portfolio monitoring, particularly with regard to climate. Initiatives such as the Task force for Climate-related Financial Disclosures have led to extensive development of climate metrics, and their widespread adoption.

Investors are also making efforts to integrate ESG considerations into their performance attribution processes (identifying what active management decisions have driven their returns). Managers have developed several techniques in this area, but isolating the impact of ESG factors on portfolio returns remains very challenging.

Downloads

ESG integration in listed equity: A technical guide - April 2023

ESG Integration in Listed Equity: A Technical Guide (Chinese) 股票ESG整合

Topics

- Asset owners

- Climate change

- Climate change for public markets

- Listed equity

- Monitoring managers

- Stewardship

Related content

Call for Policy Action: Building Investor Momentum for a Whole-of-Government Approach to Climate Change

2024-10-01T07:00:00Z

Six takeaways from the 2024 proxy season - and why voting remains a critical tool for investors

New York Climate Week, COP16 and COP29

Meeting investors where they’re at: PRI launches new strategy

More from Listed equity

Net zero in practice: Insights from equity investors

Itaú AM: Integrating climate scenarios into investments

UBS SDIC FMC: Bridging the gap in ESG integration standards

SBIFM: Applying an ESG assessment framework to IPO companies

- About the PRI

- News and press

- Annual Report

- PRI governance

- Support us

- Careers

- Contact us

- Modern Slavery Statement

- Collaboration Platform

- Data Portal

- Reporting Tool

- Privacy policy

- PRI Academy

- The PRI is an investor initiative in partnership with UNEP Finance Initiative and UN Global Compact.

- PRI Association, 25 Camperdown Street, London, E1 8DZ, UK

- Company no: 7207947

- +44 (0)20 3714 3141

- [email protected]

- PRI DISCLAIMER

The information contained on this website is meant for the purposes of information only and is not intended to be investment, legal, tax or other advice, nor is it intended to be relied upon in making an investment or other decision. All content is provided with the understanding that the authors and publishers are not providing advice on legal, economic, investment or other professional issues and services. PRI Association is not responsible for the content of websites and information resources that may be referenced. The access provided to these sites or the provision of such information resources does not constitute an endorsement by PRI Association of the information contained therein. PRI Association is not responsible for any errors or omissions, for any decision made or action taken based on information on this website or for any loss or damage arising from or caused by such decision or action. All information is provided “as-is” with no guarantee of completeness, accuracy or timeliness, or of the results obtained from the use of this information, and without warranty of any kind, expressed or implied.

Content authored by PRI Association

For content authored by PRI Association, except where expressly stated otherwise, the opinions, recommendations, findings, interpretations and conclusions expressed are those of PRI Association alone, and do not necessarily represent the views of any contributors or any signatories to the Principles for Responsible Investment (individually or as a whole). It should not be inferred that any other organisation referenced endorses or agrees with any conclusions set out. The inclusion of company examples does not in any way constitute an endorsement of these organisations by PRI Association or the signatories to the Principles for Responsible Investment. While we have endeavoured to ensure that information has been obtained from reliable and up-to-date sources, the changing nature of statistics, laws, rules and regulations may result in delays, omissions or inaccuracies in information.