As a startup entrepreneur, obtaining funding is one of the most crucial steps for success. Angel investors play a pivotal role in this journey, offering not just money but also valuable guidance and industry expertise.

But what, exactly, are angel investors and how do they work? This comprehensive guide breaks down the who, what and how of these entrepreneurial benefactors. By understanding the definition of angel investors, the differences between angel investors and venture capitalists, and the ways angel investors operate, you’ll establish a strong foundation for your fundraising journey.

An angel investor, commonly referred to as an “angel,” is a high-net-worth individual who offers financial backing to early-stage startups and entrepreneurs in exchange for equity in the company. This financial support is particularly crucial during the initial phases when securing traditional funding from banks or other institutions can be challenging for fledgling businesses.

Unlike venture capitalists, who invest pooled funds, angel investors use their personal capital to support promising ventures. Their involvement in the early stages of a startup is marked by a willingness to assume higher risks in exchange for the potential for significant returns as the businesses they support mature and prosper.

In addition to providing financial resources, angels often contribute valuable industry knowledge, mentorship and networking opportunities, helping startups navigate the complexities of entrepreneurship and increase their chances of success. By nurturing the development of new and groundbreaking ideas, they play a pivotal role in fostering innovation and driving economic growth.

The term “angel investor” is believed to have originated from the Broadway production community in New York City during the early 20th century. Wealthy individuals who provided financial support for theatrical productions were colloquially referred to as “angels.” This metaphorical usage likely stemmed from their role in enabling the creation of performances that might not have been feasible through traditional financing channels.

The term evolved and gained prominence in Silicon Valley during the technology boom of the 1970s and 1980s. One of the earliest known references to the term “angel investor” in a business context is attributed to Professor William Wetzel, who used it in his studies on entrepreneurship at the University of New Hampshire during the 1970s. Wetzel’s work focused on the role of informal investors in providing crucial early-stage funding for startups. The concept of angel investors providing this form of support became more widely recognized during this period, with the term gradually transitioning from an informal descriptor within entrepreneurial circles to a standard designation in the broader business lexicon.

The distinction between an angel investor and a venture capitalist lies in the source of funds, investment approach, and the stage of the startup life cycle they typically engage with. An angel investor is an individual who uses their personal wealth to invest in early-stage startups. They may provide pre-seed funding or seed funding when the business is in its infancy. Angel investors are known for taking on higher risks, as they invest their own money and are more likely to support ventures based on personal interest or industry expertise.

On the other hand, a venture capitalist is a professional or a firm managing pooled funds from various investors, such as pension funds or institutions. VCs usually come into play during later stages of a startup’s development, such as the series A, B or C funding rounds. Unlike angel investors, venture capitalists are accountable to their investors and have a fiduciary responsibility to deliver returns on the funds they manage. VCs are often involved in larger deals and seek more substantial ownership stakes in the companies they invest in.

While both angel investors and venture capitalists contribute not just capital but also mentorship and guidance, their roles in the startup ecosystem vary. Venture capitalists, managing institutional funds, tend to engage in later-stage funding rounds and adhere to a more structured investment process. Angel investors operate with more flexibility and autonomy due to their personal investments, focusing on early-stage, high-risk opportunities.

The mechanics of how angel investing works can be broken down into several key steps:

Understanding these steps helps prospective angel investors navigate the complexities of the investment process and maximize their chances of supporting successful and innovative startups.

Most of the time, angel investors use their own personal savings to fund startup investments. They may acquire their initial capital through other entrepreneurial success, such as the proceeds from a previous exit.

Angel investors may also form strategic alliances with other investors, creating angel investor groups. Pooling resources enables them to participate in larger funding rounds, diversify their portfolios, and share the due diligence and mentorship responsibilities. Alternatively, they may turn to online crowdfunding platforms, which allow multiple startup investors to contribute smaller amounts of capital to collectively fund a startup.

While angel investors are individuals, they sometimes operate through limited liability companies, businesses, trusts or investment funds for tax and legal purposes.

An angel investor highlights their preferences and criteria in their investment profile. For entrepreneurs, understanding an angel investor’s investment profile is crucial for aligning their startup with the investor’s preferences.

An investment profile typically includes industry focus, preferred investment stage, geographical preferences, investment size, risk tolerance, exit strategies, level of involvement and mentorship, considerations of social impact, and a track record of previous investments. Investors may indicate their preference to specific sectors, their comfort with varying risk levels, and their preferred roles in supporting startups.

By understanding this information, entrepreneurs can tailor their pitch based on the investor’s industry expertise, risk appetite and desired level of involvement. Likewise, investors can effectively communicate their strategic objectives and attract opportunities that resonate with their unique investment criteria, fostering a transparent and mutually beneficial relationship for both.

Professional angel investors aim for returns of at least nine times their original investment within a five-year period , though this is an ambitious amount in reality. This high goal is a response to the fact that a large percentage of angel investments may be lost entirely if early-stage companies fail.

Despite the need for high rates of return, which can make angel financing seem expensive, alternatives such as bank financing are typically not available for most early-stage ventures. The amount of equity they seek averages around 20% , with some aiming for as high as 50%. That said, advisors say that a guiding principle for entrepreneurs should be to offer between 10% and 20% of equity to angel investors.

Angel investors, with their willingness to take risks and provide crucial financial support, play a key role in helping innovative ventures take flight. However, like any form of financing, engaging with angel investors comes with a set of advantages and disadvantages. Entrepreneurs must carefully weigh these factors to make informed decisions that align with their business goals and vision.

The advantages of angel investors for entrepreneurs include:

Despite these benefits, there are also a few disadvantages of angel investors :

In weighing these advantages and disadvantages, entrepreneurs must carefully evaluate their funding needs, long-term goals, and the compatibility of potential angel investors with their vision for the business.

If you decide angel investors are right for your startup, you can easily connect with them through online platforms and organizations. Here’s where you should be looking:

As you look for angel investors, keep in mind that angel investors typically show interest in innovative ventures with high growth potential and a scalable business model. Technology-based startups, particularly those in the fields of software, biotech and clean energy, often draw attention due to their disruptive nature and potential for substantial returns. Sectors with proven market demand, such as healthcare, fintech and artificial intelligence, also tend to attract angel funding.

As a general rule, angel investors prefer startups with a compelling value proposition, a well-defined target market, and a clear strategy for market penetration. While industry diversification exists, startups that align with the investor’s expertise or personal interests may have a higher likelihood of securing angel financing. Ultimately, angel investors seek opportunities where their financial support can significantly impact a startup’s growth trajectory and lead to sustained success.

Angel investors come from various professional backgrounds and experiences. While some are seasoned entrepreneurs who have successfully navigated the startup landscape, others are executives or industry professionals seeking investment opportunities outside their day-to-day roles. High-net-worth individuals with disposable income and an interest in fostering innovation are commonly drawn to angel investing.

Likewise, it isn’t unusual for individuals to transition into angel investing after a successful exit from their own startup or corporate career, driven by a desire to contribute to the next generation of innovative ventures. Former or retired entrepreneurs, known as “founder angels,” may choose to reinvest their wealth and expertise into promising startups.

While most angel investors are accredited because it opens up access to more investment opportunities, accreditation is not a prerequisite of becoming an angel investor. Accredited investors typically meet specific financial criteria, such as high income or substantial net worth, enabling them to engage in high-risk ventures like early-stage startups. On the other hand, non-accredited angel investors may not meet these stringent financial requirements but nonetheless play a role through financial backing and mentorship.

Angel investors provide significant financial support, valuable industry insights and hands-on mentorship, all of which is particularly beneficial for early-stage startups. That said, you should do your research on the right types of investors for your startup – whether they’re angel investors, venture capitalists, or crowdfunding professionals – before moving forward.

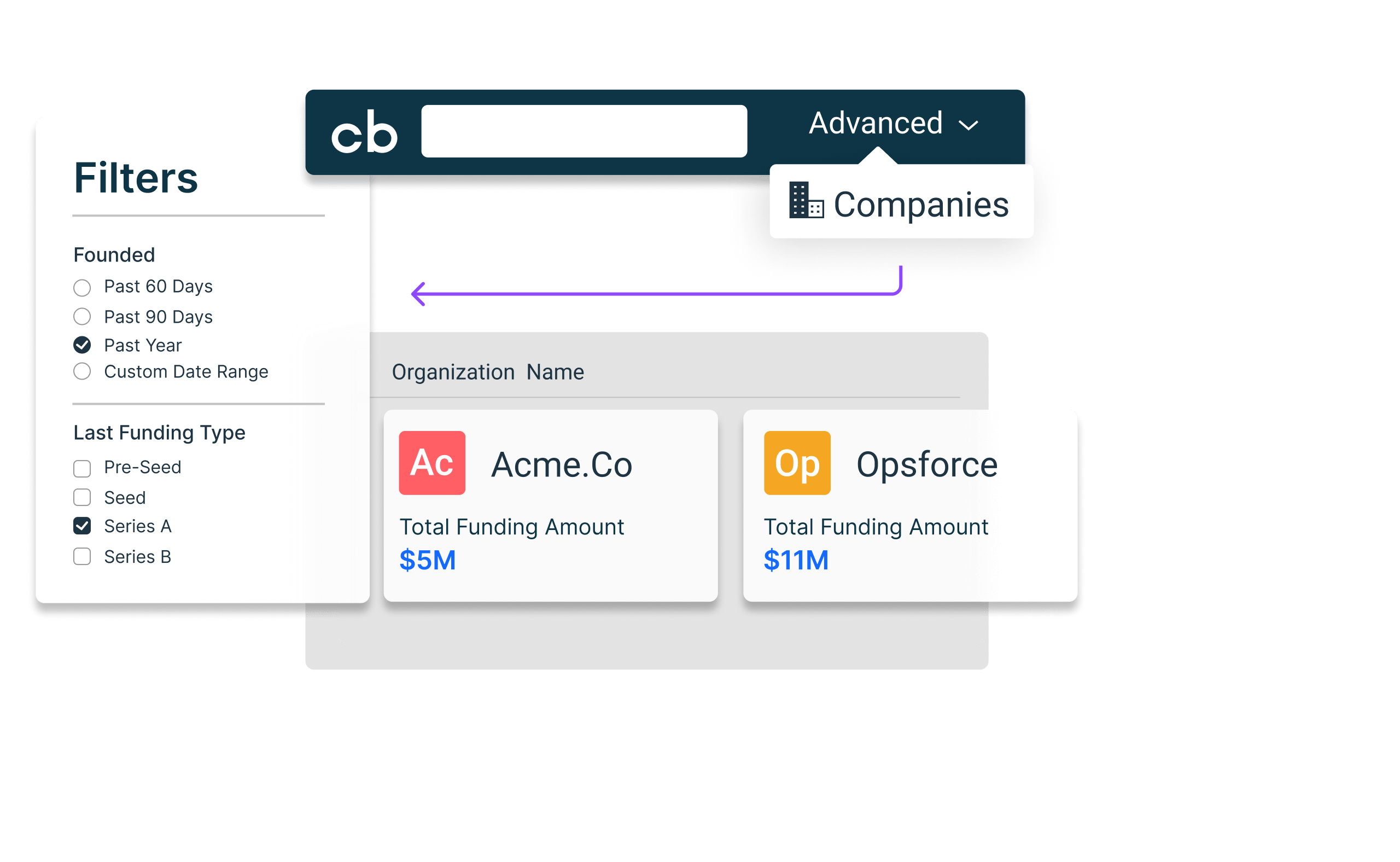

Whichever funding strategy you ultimately choose, you can use online platforms to connect with experienced investors who are aligned with your startup’s vision for growth. Crunchbase, in particular, surfaces active investors in your industry and provides verified contact details so you can connect with the right people. Learn more about finding investors on Crunchbase.